With 10 years of experience in both marketing and gaming, Chief Marketing Officer of Parimatch International Dmitry Belianin addresses some of the effects of the pandemic on the industry and what we can learn from this global event

The COVID pandemic has opened the door for some brands to rethink their business approach, and they should take this opportunity as perhaps it won’t come back once more (at least, I really hope so).

Indeed, even the best organization is full of the superfluous complexities and expenses of previous periods and prior methodologies.

COVID will clear out an insane amount of organizations in the months to come and it already did, just a bit. In any case, for those that remain and realize that they will suffer, there is currently a chance to cut the tons of unwanted stuff and smooth out the efficient at no other time. I have been chatting with colleagues from different gambling brands, and trust me, everybody is too concerned.

The good news about the situation is that it presented us with a time of customer pause and strategic clarity. There was no sports, there was no going outside of the office or to the sports betting retail shops. It was us and our business only—one against each other.

I am not saying that COVID will make a huge difference, so you need to re-examine your business. That is the opposite. COVID won’t transform anything once it finished, besides giving organizations a vital opportunity to do what they ought to have done yet couldn’t do

because there was a lot of weird stuff going on.

We see that consumer behaviour is changing, switching primarily to online. Sports fans are hungry even more than before. We see that after the English Premier Leagues’ resume, Sky Sports has reported an increase in their numbers. Our goal is to satisfy these sports fans’ growing needs.

So, telling about the things that will be the difference between those who are adjusting and those who are patiently following with their current approach:

1. Brand portfolio

Along these lines, most importantly, it is a brand portfolio. Each organization has an excessive number of brands. Include many years of acquisition, extension, development, and experimentation. You, for the most part, show up at a brand portfolio that is so enormous, and none of the leadership team can really list all the brands they are intended to oversee. Furthermore, they continue making more. It is the perfect opportunity to arm your management with the killswitch to settle on an intense choice. This will permit you to focus on the existing, profitable, growing brands, and make them even more successful.

2. Brand, and it’s pricing power

I think that something once went wrong. We, marketers, have failed to educate people from the finance department and the leadership team of the brand’s power. Maybe if we rephrased the term ‘brand’ to ‘pricing power,’ things would be better? Buffett says that ‘if you have the power to raise prices without losing business to a competitor, you have a very good business.’ A crucial part of the ability to create inelastic price products is how strongly people feel about the brand. If you’re dealing with a commodity, then any price (aka odds, RTP, margin, whatever) increase will cause a resulting decrease in sales, our case – active players, and their engagement. But suppose you have a strong and distinctive brand which you’ve cultivated and invested in overtime. In that case, people won’t mind a price increase. Look at Netflix, Apple, or any other luxury brands, such as Chanel (on the picture below).

The lessons are – don’t underestimate your brand, its value, and don’t even stop investing in it, even during the pandemic.

3. Product mix

The next one is a product mix – It’s the same story for products. Just as companies have too many brands, they also have too many products. Most companies are doing 80% of their profits, with 20% of their products. Here comes the question of why anyone would still stay around with 80% of products that make just 20% of profits? I have no clue. Coronavirus again presented companies with a golden moment to review the product portfolio and make tough decisions. Stop paying royalties for something that slowly drains money from your players and prevents them from playing into something more interesting from both players and business perspectives.

4. Channels of distribution

Operators have built up a retail network that also makes no sense to anyone. But because deals have been done, and stores are opened, and territories created, no-one dare suggests that channels can and should be trimmed back. In one of our countries – Tanzania – we at Parimatch made a bold move to shut down the whole retail network. It took us just a bit of time educating and transferring players online. Eventually, we experienced a drastic increase in the number of bets, and of course, GGR. Playing from the smartphone from any place you want to play is a hell of an experience.

The simple truth of distribution is that it should always reflect the company’s business strategy behind it. If you are a simple, direct brand, you should operate a simple, natural distribution system.

Again, as COVID causes the lowest tide in recorded retail history, there is a chance to revisit the distribution strategy now and make the crucial changes. The whole world is going online, and it is eventually everything about the GGR numbers, right? Then it comes to marketing budgets, which is my favorite part. The biggest problem in marketing in most companies is the way that budgets are set. Most marketing departments are ‘given’ their marketing budget after the finance team has either calculated how much money the company will make next year or applied a percentage of active players to that number. It’s total nonsense but sometimes – impossible to stop until now. With most firms were not expecting to start advertising again until the EPL was back in June or later, a once-in-a-lifetime opportunity emerged to take time to think about marketing budgets more deeply and avoid the from top to down advertising-to-GGR ratios.

It’s usually tough to get a company to consider zero-based budgeting because it’s such a total shift in approach for them. But coronavirus has created a temporary zero base for many companies.

They have had to stop spending marketing money and, in many cases, also stopped receiving any GGR because switching the whole marketing campaign and product vertical’s approach is pretty hard. That means the budget clock has stopped. We had a rare opportunity to see marketing as an investment and make a new case for marketing money based on what it can do for the business, rather than on what we spent last year.

And at the same time, when you are creating the budget, think about the 60/40 rule. For many companies, the addiction to short-term performance marketing means little or even no money is invested in longer-term emotional brand-building. But with so many businesses

seeing no immediate increase in their active players’ numbers out there for many more weeks, there was an existential opportunity to pause all short term ROI-based marketing spend but maintain longer-term branding investments.

Those long-term investments will work better with so many competitors pulling back. When the real sports crisis ends, they will have created a significant steam head as consumers head back to find a place to place bets.

Most companies are going to cut their marketing budgets for the rest of 2020. But the smart ones will – at the very least – spend a bit of money to keep their brand marketed and out there in the market, increasing their SOV over the abandoned competitors’ brands.

_____

The article is inspired by Mark Ritson, Nirmalya Kumar, and Peter Field.

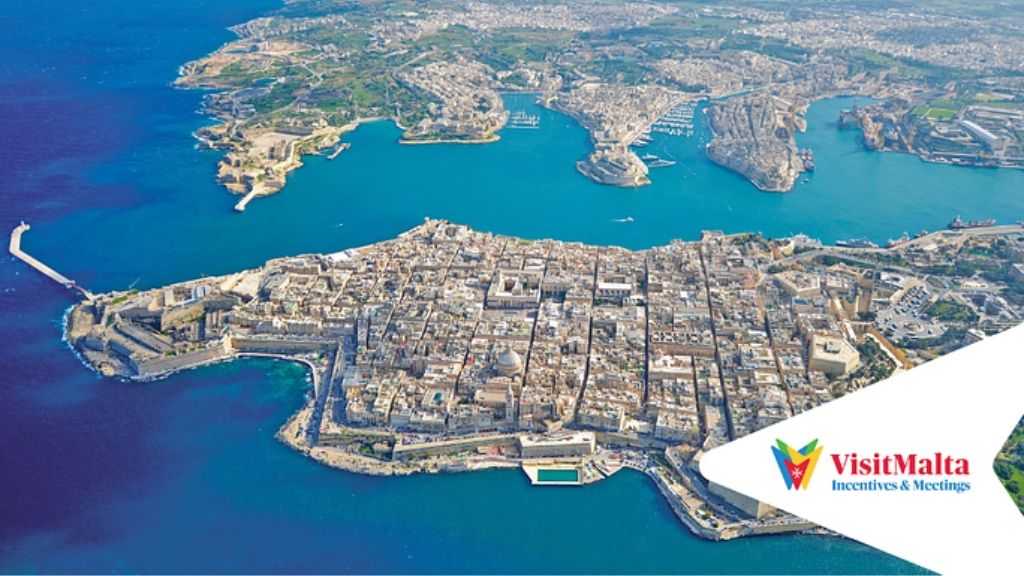

SiGMA Americas:

Following the successful launch of SiGMA Europe (Malta) and SiGMA Asia (Manila), we’re now launching the inaugural SiGMA AMERICAS, covering all three major timezones. The inaugural edition is set for September 22-24, 2020 with a virtual summit focusing on two themes: SiGMA AMERICAS for the Gaming industry and AIBC AMERICAS for the Emerging Tech industry. We wanted to provide fresh content, to help you navigate through these turbulent times. If you’re exploring Americas as a new frontier or wondering which tech solutions to embrace, we’ve got you covered: tune in on September 22-24, 2020.