Africa clearly has the potential to be at the forefront of the online gambling industry with the continent ready to implement fit for purpose regulations, user friendly platforms and competent regulators

Africa is a dynamic gaming space; however a lot of investors have gotten their fingers burnt by having little knowledge of the continent. Its laughable when l hear stuff like, Africa is a country. I cannot but laugh loud at such ignorance but to be frank, little is known about the continent. Most information pushed out there by foreign media portrays Africa in bad light, which puts off a lot of would be investors. They are not to be blamed totally though, our political leaders have also not helped in that regard. They have largely contributed to the backwardness and underdevelopment prevalent in Africa. Online gambling companies are looking to diversify their business models, now more than ever. Sub-Saharan Africa seems to be the darling when gambling executives are thinking of an offshore investment. The reasons are not farfetched.

Gambling markets in Europe are almost saturated and highly regulated. America is not any better despite the PASPAL ruling, though significant investment has been made in that direction. South East Asia and Latin America does not possess the youthful population prevalent in Africa. Another serious factor considered when looking at an offshore investment in Africa, is the fact our gambling regulation is very weak and laced with corruption. Take or leave it, it’s a critical factor, that’s the cold hard truth.

Though largely unregulated in the online gambling sector, Africa regulators are very well versed, ready  to bring in regulation that is fit for purpose, user friendly for consumers and operators alike. When looking at Africa, the continent has the potential to become one of the largest online gambling markets in the world. With a densely populated youth, growing mobile industry, strong payment structure couple with ever changing and ever ready gaming regulators, the industry is set for an exponential growth.

to bring in regulation that is fit for purpose, user friendly for consumers and operators alike. When looking at Africa, the continent has the potential to become one of the largest online gambling markets in the world. With a densely populated youth, growing mobile industry, strong payment structure couple with ever changing and ever ready gaming regulators, the industry is set for an exponential growth.

The three biggest markets in sub-Saharan Africa, South Africa, Nigeria, and Kenya are unique in the area of regulation and quite dynamic in operation. Lumping all countries in Africa together is a prescription for failure. The emerging gambling markets in Africa are Democratic Republic of Congo (DRC), Tanzania, Cote d’ivore, Cameroon, Uganda, Rwanda, Senegal and Sierra Leone while the frontier markets are Ethiopia, Burundi and Namibia. This piece provides useful information on how to invest in the gambling business in Africa. It’s a must read for top gaming executives and foreign investors wanting to invest in Africa’s gaming market.

Knowing and understanding the regulatory landscape

The first and most important thing is to have a clear picture of the regulatory landscape of the particular jurisdiction you’re investing in or the region depending on your mission. You should have a good understanding of how to obtain license, what laws and frameworks are in place. You should know which countries are already regulated and how strong the markets are in each country. Countries close to been regulated, licenses that are available and conditions they come with? The operator should also assess the situation and know whether operators in such markets are operating to internationally acceptable standard and global best practice.

Understanding the tax regime

Gambling was once relegated to the back burner in sub-Saharan Africa and in the process missing out on the huge tax accruable to various government. For any investor wanting to investor in Africa, you must fully understand the tax regime in your area of choice. Gambling tax in Africa differs from country-to-country. For instance, there is a Lottery tax in Nigeria which is paid to the Lottery trust fund and corporate tax. Understanding the tax regime allows the investor know the percentage of its revenue that it has to pay as tax so as not to be on the wrong side of the law. Full understanding of the tax regime in your area of choice enables you to know if it’s advisable to invest in such

area. Gambling business is all about volume of trade, tax paid to government definitely affect your bottom line, and therefore it is very fundamental to know the different tax available.

Obtain the necessary license and work with regulators

Obtaining the necessary license needed for your operation in Africa is very cogent. The landscape in most sub-Saharan Africa is quite dynamic and constantly changing. Operators and suppliers wanting to invest in Africa’s gambling industry must obtain a license from established regulators before starting their operations. Operating an offshore gambling brand is not advisable as this will put such an operator in bad light. It should be stressed that having an experienced personnel on ground is a no brainer whether that takes the form of partnership or a joint venture.

In Africa football is king

Before investing in Africa, you need to understand which of the betting verticals players prefer to play. Depending on where you are going to operate, be it Southern, East, West or North Africa, players engage differently but Football is king here. Sport betting is strong in all betting legalized jurisdictions in Africa and it’s the fastest growing in the gambling industry. Africa is a football frenzy continent where National Teams and footballers are passionately followed. All over Africa, footballers that play in foreign leagues are heroes especially those who play in major European competition like the champions league and Europa League.

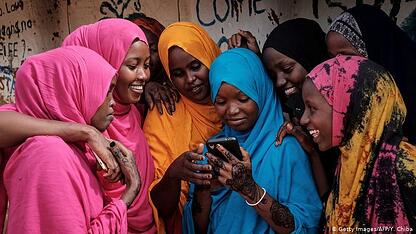

Product offering and accessibility

Any betting product in Africa that is not youth centric and not accessible via smartphone will find it difficult to fly. Millennial should be the focal point of your product because they mostly engage in betting. A continent whose youth population is between 18 and 25 and has the fastest growing youth population in the world presents a good platform for demographic product offering. Across Africa,  mobile dominates with most of the locals possessing smartphones made available through a payment scheme that allows for payment to be made on installment basis. Most people now use smartphones to manage their everyday lives and also wager online. A continent in which nearly half a billion people use smartphones according to the latest GSMA reports simply point in one direction when thinking of a product in Africa; mobile. For casino, poker and horseracing, South Africa is the right place to invest, while horseracing is the number sport in Mauritius. Esport is strong in South Africa, Egypt, Nigeria and Tunisia.

mobile dominates with most of the locals possessing smartphones made available through a payment scheme that allows for payment to be made on installment basis. Most people now use smartphones to manage their everyday lives and also wager online. A continent in which nearly half a billion people use smartphones according to the latest GSMA reports simply point in one direction when thinking of a product in Africa; mobile. For casino, poker and horseracing, South Africa is the right place to invest, while horseracing is the number sport in Mauritius. Esport is strong in South Africa, Egypt, Nigeria and Tunisia.

Though gambling is not allowed in all North Africa countries, Egypt and Morocco allow casino for tourists only. In East African countries, online is very strong and they mostly engage in sport betting. Though majority of the countries in West Africa are francophone, meaning, they mostly speak French language, Sport betting is also the leading betting vertical here. Francophone Africa provides an interesting betting scenario for investors but the region is different culturally from Anglophone Africa.

Volatility of political environment

Operators wishing to have an offshore investment in sub-Saharan Africa must clearly understand the political environment of such jurisdiction. Though a lot of countries in Africa are democratic, however many still go through turbulence during general elections and change of democratic powers. Anytime there is a new government, it affects political appointments and this is so particularly of Nigeria. For instance heads of regulatory bodies in Nigeria can be changed if there is a change of government and will definitely affect operation at the federal or States depending on where such a change takes place. Political history of your area of choice must be well understood and this must be done without bias or else, your guess is as good as mine.

Repatriation of Funds and strength of local currency

Restrictions in many African countries can make it difficult for investors to move cash to where it’s needed. For foreign investors operating in Africa, the issue of trapped cash looms large. Companies may generate healthy amount of cash in a particular market, but if that market has restrictions or local exchange controls in place, it may be difficult to repatriate funds to another location. In some cases, these constraints can leave companies with hundreds of millions of dollar trapped in such countries. Some countries have stringent foreign exchange regulations in place while some countries have been known to restrict companies from purchasing US dollars.

Many countries in Africa have also been known to prioritize local banks over foreign banks when it comes to availability of foreign currency. Multiple exchange rate and weak currency is prevalent in Africa because of external borrowing. One of the conditions of non-governmental foreign institutions when approached by third world countries especially Africa is the devaluation of its local currency vis-à-vis notable foreign currencies like dollar, pounds and euro. A weak currency connotes a weak economy. What further compound the problem is to have multiple exchange rates in country like we have in Nigeria. There are multiple steps that can be taken to overcome these issues but different techniques will need to be used in different markets.

Ease of doing business and infrastructural development

Ease of doing business refers to how simple it is to set up and conduct businesses in a particular country. Some countries deliberately make it very difficult for foreign businesses to open and even thrive. This is done at times to protect local businesses and also keep money in the country. Still that doesn’t mean that you shouldn’t look at expanding to a new country. Sub-Saharan Africa remains one of the weak-performing regions on the ease of doing business; however a lot of them are carrying out reforms. Mauritius, Rwanda and Morocco are the leading countries in Africa when it comes to ease of doing business. Most of the reforms address aspects of starting a business, dealing with construction permits, getting electricity, paying taxes and lending. In Nigeria, the present administration has implemented some far reaching reforms in line with Ease-of-Doing-business initiative. Visa at the point of entry and tax holiday are some of the things that have been put in place by this administration to encourage foreign investors. Ease of doing business is something that investors must look at when considering an offshore investment in Africa.

Country-to- country analysis of sub-saharan Africa is necessary

Its laughable to still refer to Africa as a country. To be successful as a business man in the continent, an individual assessment of each country is vital because it allows for proper planning. Africa has diverse language, culture, political and business environment. Understanding each country allows you to design products that fit into that environment, coming with a one-fit-all product is a prescription for failure. Good understanding of the business climate of area of choice is very key.