From founding Sportingbet plc, one of the world’s largest bookmaking operations, to pioneering in iGaming, Mark Blandford is a gambling and investment giant. He shares the latest insights from his venture capital investing career with Matthew Calleja.

In your view, how would you assess the current state of the gaming industry? Have you noticed any significant uptick in iGaming activity recently?

The gaming industry is currently thriving, with robust attendance at events like SiGMA and continued growth of public companies. While the pandemic initially impacted the industry, resulting in some tough comparators, operators experienced a 30% surge in activity during lockdowns.

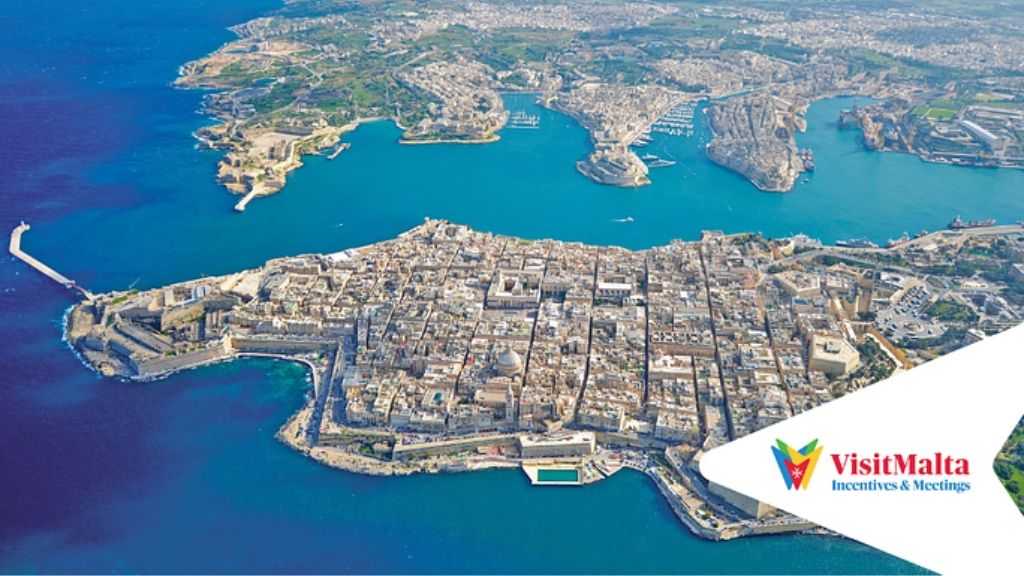

Many companies are eager to catch up on missed opportunities to interact with suppliers, customers, and partners, driven by a fear of missing out. I’m uncertain how Malta will handle the high number of visitors expected at next year’s SiGMA Malta Week. Nonetheless, I have no doubt the team will do a stellar job.

What trends do you look for when investing in businesses or markets? Specifically, what do you look for in the companies you invest in or their target audience?

We look for established businesses with clear market opportunities that don’t appear to be well-served. We prefer data-driven businesses that utilise artificial intelligence and smart decision-making.

Once we identify these businesses, we focus on getting to know management and evaluating whether they are the right people to capitalise on the opportunity. Management is a significant part of our decision-making process. Early trading data is also important for modelling the impact of deploying more cash and determining a fair valuation.

AI seems to be very beneficial for the gaming industry as a whole. However, do you foresee any potential drawbacks that could arise with the use of AI?

I believe that AI has tremendous benefits, but there is a lot of hype around ChatGPT, which reminds me of the early days of the internet when companies received overinflated valuations. Although ChatGPT has potential, the accuracy of the answers is currently limited and dependent on only a few sources.

However, as with any new technology, it will improve over time. While it may not completely revolutionise the industry, I see AI as more of an evolution. As an investor, I believe in taking a measured view of its applicability rather than relying on hype.

I’m eager to explore the investment options you mentioned earlier. Where would you like to begin?

Probably by highlighting the outstanding performance of one of our invested companies. The Gambling.com Group is a great success story, having recently been listed on NASDAQ. I discovered this company at an early stage, back in 2008, when I met one of its co-founders, Charles Gillespie. Since then, it’s been fascinating to see how the team has developed the business, from acquiring the Gambling.com URL to realising our vision for it, which previous owners had failed to do.

The company has built a portfolio of strong brands, achieved robust organic growth, expanded geographically, and moved into targeted markets. Originally based in Europe, the company now operates on a semi-global basis and is investing heavily in the US, where regulation of sports betting and iGaming is rolling out.

And what of your invested company Gaming Realms? What do you think sets Gaming Realms apart from other UK-based developers and distributors in the industry?

I find Gaming Realms to be an exciting company, and I have been on the board for about two and a half years. What sets them apart is their specific focus on branded games in a particular genre, such as the popular game Slingo, which we own the intellectual property for. With a strong brand and successful games that generate revenue, Gaming Realms has been growing organically under Michael Buckley’s leadership.

You have mentioned preferring data-driven businesses when investing, which is quite relevant to your investments in Synalogik and Future Anthem. How is data driving innovation in this industry?

Synalogik focuses on enhanced due diligence, investigations, and anti-fraud solutions using open and internal data sources. Future Anthem utilises gameplay data provided by clients to predict player behaviour using AI, providing operators with valuable insights to optimise play and offer targeted promotions. Both companies offer data-driven solutions to enhance customer service and address social responsibility considerations in the gambling industry.

Has there been any regulatory hurdles to overcome concerning data?

With Synalogik, the data primarily comes from open sources such as electoral rolls and Companies House data. As this data is in the public domain, there isn’t as much sensitivity surrounding its use. However, with Future Anthem, the gameplay data is collected from customers, but their personal identification data is not used in any way. Instead, they are given a customer number, and their gameplay is analysed to draw assumptions. This means that the privacy of the individual is protected, and the company does not face hurdles related to data sensitivity.

Can you discuss FSB Technology’s positioning and strategies in the sports betting market, particularly in relation to their product’s attractiveness to the target audience?

FSB is a modular B2B sports and casino platform that allows clients to customise their options. As a co-founder of SportingBet, I have experience in bookmaking and understand the necessary tools for a platform to grow successfully.

FSB is a modular B2B sports and casino platform that allows clients to customise their options. As a co-founder of SportingBet, I have experience in bookmaking and understand the necessary tools for a platform to grow successfully.

When I got involved with FSB in 2007, I saw an opportunity to help the team build risk management tools, which have consistently beaten industry average margins. It’s impressive to see the progress made since the early days, and I’m proud to have contributed to its growth.

How does BeBettor allow for customer affordability testing, and can you provide more information on the process and tools used for this testing?

BeBettor is a RegTech company that uses open data sources to calculate affordability for affordability testing, categorising customers based on property values, job level, and likely salaries. BeBettor’s approach avoids asking customers to justify their gambling amounts or collecting intrusive proof, which helps maintain customer privacy and prevent customer churn.

Affordability and source of funds are two distinct but related concepts, as illustrated by a recent case of a nurse who gambled £240,000 in a few months, raising questions about both affordability and the source of funds, including the possibility of money laundering.

As a seasoned veteran in the gambling industry, what would your final remarks be to an inexperienced yet ambitious individual thinking of dipping their toes in?

At a high level, the industry is entrepreneurial and there is still room for growth, so I’d say come on in, the water’s great! Look for clear market gaps and formulate a strategy to address them profitably.

Learning from past mistakes is crucial to success, and it’s important to avoid making the same mistake twice. I also can’t stress enough the importance of upfront decision-making and clear leadership for successful business synergies.

For read about more sensational insights and pioneering innovations, check out the latest edition of SiGMA Magazine here.