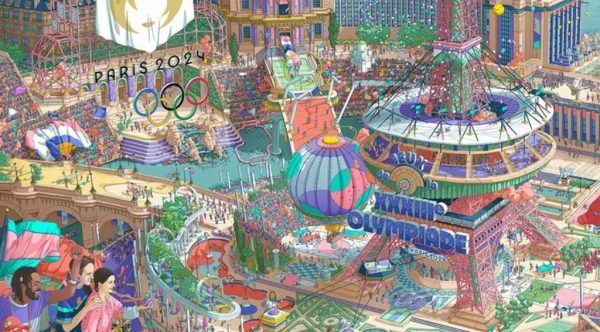

The Paris 2024 Olympics are set to kick off with an unprecedented and ambitious opening ceremony along the iconic River Seine. Billed as the biggest open-air show on Earth, this spectacle will shut down the city centre and its airspace, mobilize 45,000 police officers, several army units, and has taken two years of secret rehearsals to prepare.

This much-awaited for event promises to be unforgettable, showcasing Paris’s rich cultural heritage and spirit of innovation. As the world watches, Paris will once again prove why it is known as the City of Light.

For the first time in Olympic history, the opening ceremony will take place outside a stadium. Instead of the traditional parade around a stadium track, over 8,000 of the world’s top athletes will be transported by boat along a 6km stretch of the River Seine. This sporting armada will be witnessed by more than 300,000 spectators from the bridges and riverbanks, with police, frogmen, and snipers ensuring security.

We decided it was the right moment to deliver this crazy idea and make it real”

- Emmanuel Macron

As the athletes glide down the river, a dazzling array of performances will unfold around them. Dancers, pop stars, tightrope walkers, and acrobats will perform daring feats on water, rooftops, bridges, and artificial islands. The show will feature pontoons, floating pianos, helicopters, and possibly even submarines, culminating in a vast laser show finale beamed from the Eiffel Tower. More than 1 billion people are expected to watch live on TV and social media.

The idea of staging such a grand event along a large stretch of river in a city under its highest terrorism alert was initially met with skepticism. Even French President Emmanuel Macron thought it was “a crazy and not very serious idea” at first.

The exact details of the nearly four-hour-long show have been kept tightly under wraps. However, as the decor, including floating skateparks, giant replicas of paintings, and oversized gold tinsel, began to be placed in and around the Seine, some clues have emerged.

Paris will transform into a spectacular sports stage

In the early evening, delegations of athletes from more than 200 countries will be bussed from the Olympic village to a spot at the Seine in the east of Paris. There, they will board boats from specially built pontoons under the guard of the French military. The delegations will then sail side by side down the Seine, past Notre Dame Cathedral and the Louvre, towards the Eiffel Tower. The Greek federation will be first, followed by the Olympic Refugee team, and then other nations, with the French boat coming last.

The Paris Olympics river parade will follow the course of the Seine for 6km, starting from Pont d’Austerlitz and coming to a stop at the Pont d’Iéna before the opening ceremony’s finale at the Trocadéro.

As the athletes sail, a revolutionary and irreverent show will unfurl around them, full of surprises. Historical monuments, rooftops, bridges, the sky, and the water will provide simultaneous settings for overlapping dance, music, acrobatics, and light shows. These performances will explore the history of Paris in all its diversity and its tradition of rebellion. Tightrope walkers will cross the river on high wires, the star French ballet dancer Guillaume Diop will perform on a rooftop, and BMX freestyle bikers will backflip over the water. The French pop star Aya Nakamura, who faced a racist backlash earlier this year over the possibility that she would sing, will also perform.

SiGMA East Europe Summit powered by Soft2Bet, will take place in Budapest from 2-4 September 2024