- Summits

- ASIAManila02-05 June 2024

- EAST EUROPEBUDAPEST02-04 September 2024

- EUROPEValletta11-14 November 2024

- EURASIADubai23-25 February 2025

- AFRICACape Town10-12 March 2025

- AMERICASSão Paulo07-10 April 2025

- News & Media

- SiGMA News

- Print & Digital

- SiGMA Media

- Directory

- Exhibiting Partners

- SiGMA’s Affiliate Club

- Selling your business?

- Foundation

- M & A Brokerage

- About Us

- Who we are

- How we help

- Let’s connect

Australian gaming company Tabcorp has witnessed a 4 percent decline in its stock value as shareholders express discontent with executive pay that they perceive as disproportionate to the company’s size and performance. During the recent annual general meeting last week, over 34 percent of shareholders voted against Tabcorp’s remuneration report, surpassing the 25 percent threshold required to trigger a “strike.” If the company incurs another strike next year, it may face the removal of its board, in accordance with the Australian corporate governance framework.

CEO Adam Rytenskild’s compensation package

CEO Adam Rytenskild’s total salary for the fiscal year 2023 amounted to A$2.07 million, which included a cash bonus. He is also eligible for a short-term incentive (STI) ranging between A$1.5 million and A$2.3 million. The board awarded him 75.8 percent of the target STI, equivalent to A$1.14 million, with half of it deferred to equity over two years.

Preceding Warnings and Tabcorp’s Defense

The shareholder revolt was not unforeseen, as three proxy advisory firms – Ownership Matters, Institutional Shareholder Service, and the Australian Shareholders’ Association – had already recommended voting against the suggested compensation packages for Tabcorp’s CEO and directors. These firms raised concerns about the lack of adjustments to director fees following the 2022 demerger with The Lottery Corporation and criticized the CEO’s short-term incentive bonus, considering it excessive given the company’s financial performance in fiscal year 2023 and its market capitalization ranking.

In response, Tabcorp’s Chairman, Bruce Akhurst, defended the company’s position, highlighting the need to balance long-term financial outcomes for shareholders with motivating and rewarding management. He emphasized the importance of aligning management incentives with the company’s strategic goal of capturing a 30 percent share of Australia’s online betting market. Akhurst assured shareholders that their feedback on remuneration matters would be taken seriously and considered in a review of remuneration arrangements.

Highlights of FY 2023 Results:

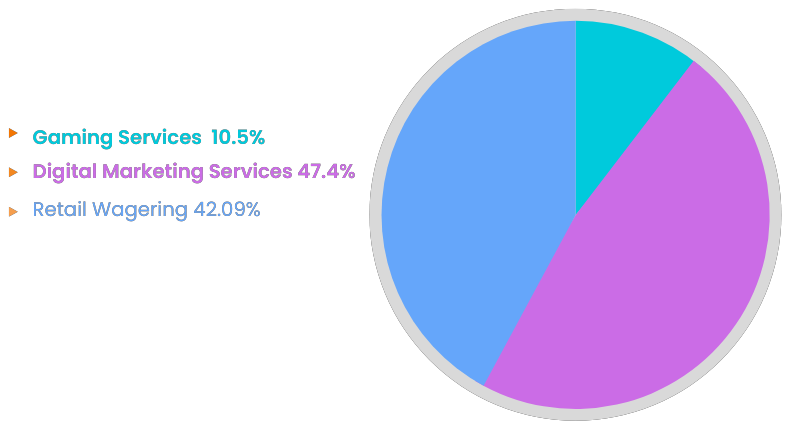

Tabcorp’s financial results for the fiscal year 2023 mark the company’s first full year of operation following the demerger, which was implemented on June 1, 2022. The financial figures pertain to Tabcorp Group’s two core businesses: Wagering and Media, and Gaming Services.

Financial Performance

- Total revenues for FY23 amounted to A$2,434.4 million, reflecting a 2.6 percent increase compared to the prior year.

- Statutory net profit after tax (NPAT) was A$66.5 million, which included a non-cash impairment charge of A$49.0 million relating to the Gaming Services business and other significant items worth A$16.4 million. This is a significant improvement compared to a statutory net loss of A$118.4 million in the previous year.

- The company reported a statutory net profit before income tax, net finance costs, and equity accounted investment of A$117.9 million, a substantial turnaround from a statutory net loss of A$75.1 million in the previous year.

- Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) before significant items reached A$391.0 million, up from A$381.6 million in the previous year.

- Statutory earnings per share (EPS) for FY23 stood at 2.9 cents per share, a positive shift from a loss of 5.3 cents per share in the prior year.

Strategic progress

In FY23, Tabcorp made significant strides in executing its TAB25 strategy, setting the groundwork for a stronger, more competitive, and growing business by FY25. This progress included the launch of the new TAB App and the introduction of ten new products aimed at enhancing TAB’s digital competitiveness.

Tabcorp also worked on creating a level playing field within the gaming industry. Reforms in Queensland resulted in Tabcorp paying the same wagering taxes and fees as online wagering operators. Similar efforts were made in the ACT and Tasmania, with Tabcorp seeking uniformity in regulations across all Australian states and territories.

Gaming services

Gaming Services made notable advancements, including securing an exclusive 20-year license to monitor electronic gaming machines in Tasmania. The sale of the eBET business was successfully completed, and Tabcorp also announced the sale of MAX Performance Solutions (MPS) after the fiscal year’s end.

Cost management and investment

The Genesis program to enhance organizational efficiency and support cost management showed good progress. Net operating expenses in FY23 were largely consistent with the previous year, with some gains from the disposal of assets, insurance recovery, and the Genesis program offset by dis-synergies from the Demerger, inflation, and savings resulting from COVID restrictions in 1H22. This cost efficiency will provide flexibility for business investment, with plans to reposition the TAB brand and continued investment in data and analytics capability in FY24.

Capital expenditure

Tabcorp recorded capital expenditure of $155.4 million in FY23.

These financial results illustrate Tabcorp’s resilient post-Demerger performance and strategic steps taken to ensure growth and competitiveness in the gaming and wagering industry.

Going forward

Tabcorp recently reported a 6.1 percent decline in revenue for the first quarter of FY2024, citing a “softer” macro-economic environment.

The company’s stock is currently trading at A$ 0.8475, a decrease of 0.0125 (-1.45%)

Related topics:

SiGMA’s next stop is Malta from 13 – 17 November

Treating crypto assets as a form of gambling would pose a risk (sigma.world)

Recommended for you

Jessie

2 days ago

Jenny Ortiz

3 days ago

Lea Hogg

3 days ago

Jenny Ortiz

3 days ago